If you're wondering how to change financial advisors, you've come to the right place. There are a few things you should remember whether you decide to switch firms. Be positive and supportive of your financial advisor. His assistance may be needed in the future. You should also get his transaction history. This will assist your new financial advisor in getting up to speed.

Transferring non-transferable assets

Transferring non-transferable assets when you change financial advisors is an option available to some clients. This can reduce tax consequences. Non-transferable asset are not available to the previous advisor. This allows your new advisor to decide what to sell and when. This gives you the ability to spread your gains and losses over time.

Before you start the process of switching financial advisors, you need to review all your contracts with your previous advisors. To ensure you don't have any restrictions on your assets being transferred to your new advisor, make sure you carefully review your contract. Some contracts require you pay termination fees or give notice.

Avoid unpleasant surprises

You should ensure you select the right financial advisor for your circumstances if it is time to change. Being a responsible investor means you must ensure your advisor is helping you to achieve your financial goals. While it is not always easy to make a decision, there are some ways to avoid making a mistake. First, find out what your advisor thinks of their work. Then, you can set high standards for them.

When changing financial advisors, read the contract carefully and ask about any fees that you might need to pay. Ask about fees and the minimum holding period for non-transferable assets. Ask about the fees involved, including redemption fees. Also, ask if your previous advisor charges a fee to transfer assets. Although it may seem uncomfortable to change financial advisers, this is better than working in an advisor that's not right.

Costs of switching financial advisors

Switching financial advisors can help you save a lot of money. However, it comes with a price: the time and effort needed to transfer client accounts and establish new client relationships. Although it is hard to quantify, this cost generally amounts to around 5 percent of your average annual productivity. You will spend approximately $50,000 on opportunity costs if your company is worth a million dollars.

Moving your financial accounts is a complex process. You will need to find a new adviser, and you will also need discuss your preferences and needs. It is better if your new advisor is familiar with you in order to make accurate recommendations. It is important to identify your most important financial goals and communicate them clearly. Once you have identified your financial advisor, assess the cost of transferring your account(s). Ask your current advisor to discuss the fees involved in transferring your accounts. It is important to read your agreements. You may be able to sign agreements electronically with your advisor.

Finding a "forever match"

There are several steps you can follow to make the transition from financial advisor to client as seamless as possible. Financial advisors tend to have long-lasting relationships. You might have been helped to get started with personal finances, set up retirement funds, or signed up for life and health insurance. These relationships can prove invaluable for your financial health in any case.

You should review your existing financial records with your new advisor. Check out the credentials and experience of the advisor. You also need to ensure that they are qualified to manage your assets. As some advisors may not be legally allowed to hold certain types or assets, it is also important that they have a license. Make sure that you give your financial advisor a copy every transaction.

FAQ

What are some of the advantages to being a Consultant?

Consultants can often choose the hours and topics they work on.

This means that you can work when you want and wherever you want.

This allows you to easily change your mind and not worry about losing your money.

You can finally control your income and create your own schedule.

Why would a company want to hire a consultant for their business?

Consulting provides expert advice about how to improve your business performance. They don't sell products.

A consultant helps companies make better decisions by providing sound analysis and recommendations for improvement.

Consultants often work closely with senior management teams to help them understand what they need to do to succeed.

They also offer leadership training and coaching to ensure that employees are able to perform at their best.

They may be able to advise businesses on ways to cut costs, improve efficiency, and streamline processes.

Why would you want to hire consultants?

You might need consultants for a variety of reasons.

-

You may have a problem or project that your organization needs to solve.

-

You want to improve your own skills or learn something new

-

It is important to work with an expert on a subject area

-

No one else is available to take on the task.

-

You feel overwhelmed by all the information and don’t know where to begin.

-

You can't afford to pay someone full-time

A word of mouth referral is the best way you can find a competent consultant. Ask your friends and colleagues if they know of any trustworthy consultants. If you already know someone who works as a consultant, ask him/her for recommendations.

Use the "Search People" function to search for consultants in your region if you are interested in using online directories like LinkedIn.

Statistics

- According to IBISWorld, revenues in the consulting industry will exceed $261 billion in 2020. (nerdwallet.com)

- Over 50% of consultants get their first consulting client through a referral from their network. (consultingsuccess.com)

- WHY choose me: Why your ideal client should choose you (ex: 10 years of experience and 6-week program has helped over 20 clients boost their sales by an average of 33% in 6 months). (consultingsuccess.com)

- According to statistics from the ONS, the UK has around 300,000 consultants, of which around 63,000 professionals work as management consultants. (consultancy.uk)

- Over 62% of consultants were dissatisfied with their former jobs before starting their consulting business. (consultingsuccess.com)

External Links

How To

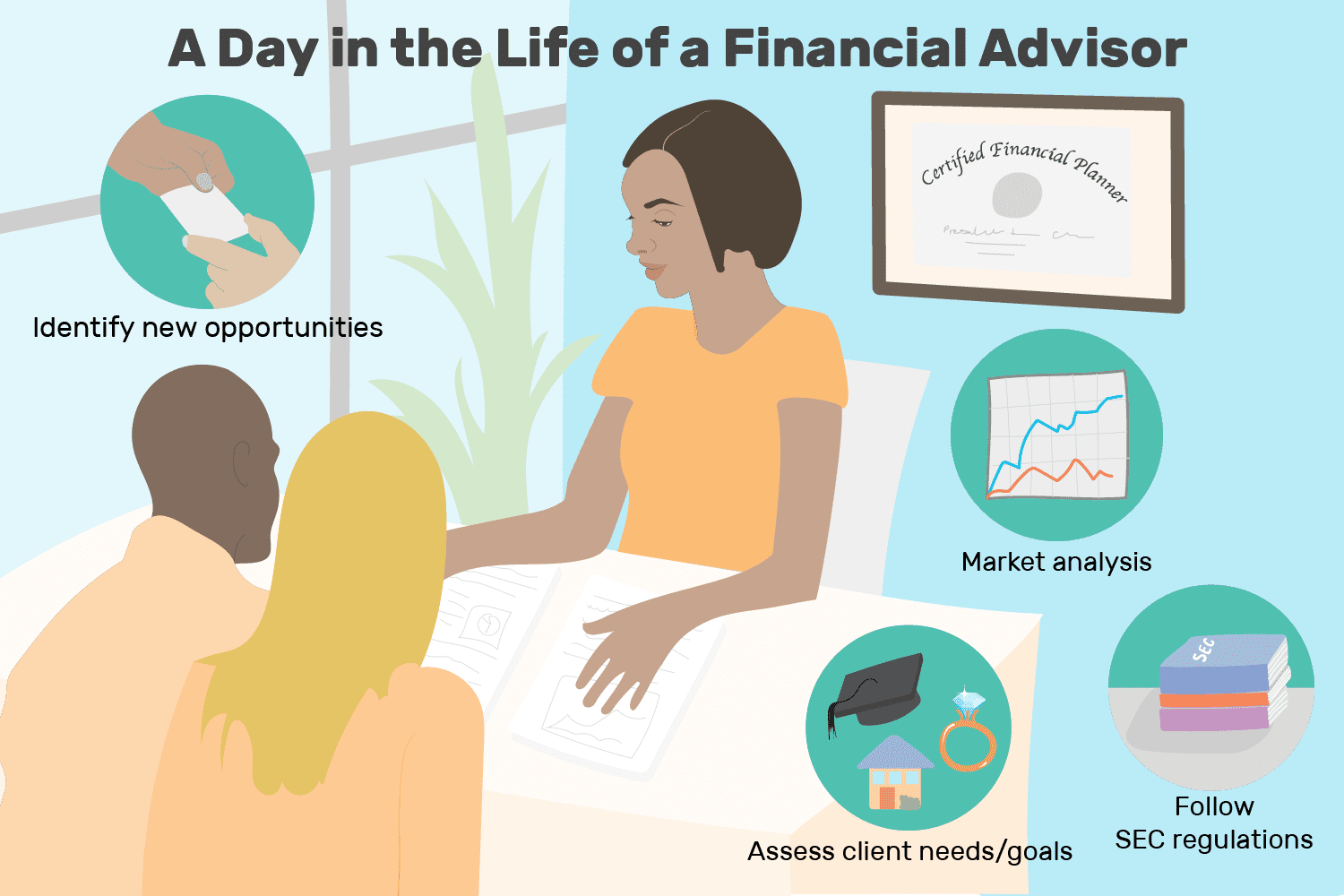

What Does A Typical Day For A Consultant Look Like?

Each type of work will dictate the day's pace. You'll spend your time researching new ideas and meeting clients.

You'll often have meetings with clients where you can discuss issues and solve problems. These meetings can be held over the telephone, online or face-to face.

Also, proposals are documents that outline your ideas or plans for clients. These proposals should be discussed with a mentor or colleague before being presented to clients.

After all the planning and preparation you will have to put your efforts into creating some content. You could write articles, design websites, edit photos or conduct interviews.

You may need to conduct research depending on the scope of your project to find relevant statistics and figures. For example, you may need to find out how many customers you have and whether they are buying more than one product or service.

Once you have collected enough information, it's now time to present the findings to your clients. Your findings can be presented orally or written.

Finally, you must follow up with clients after the initial consultation. You can call clients to ask how they are doing or send emails asking for confirmation that your proposal was received.

This process takes time, but it's important to ensure that you stay focused and maintain good relationships with clients.